The Rotation Report 2026 Market Preview

Hey what’s happening?! Happy New Year

You know - if the first few days of the year are any indication, 2026 is going to be a wild one.

We’ve got to be ready to bring it. We’ve got to know who we are, what exactly we’re trying to be doing in the markets.

You can’t just be like these New York City voters throwing shit against the wall. Our actions can be right. But boy - if we are wrong there will be consequences.

Of course in these annual previews people like to make big calls and year end price targets.

But instead of trying to predict the future - let’s start with where we are today and work from there.

Clearly the market’s bullshit detector went off in late Q3 with the Tri Color and First Brands and the other various blow ups.

And of course there was Jensen announcing deals every day and Sam Altman going full Dennis Reynolds.

Which - it’s odd that for years the market did not care about Sam. After all the man has been himself the whole time. Do not bother looking up ‘sam altman sister allegations’ or ‘open ai whistleblower’. There’s definitely nothing to see there.

But clearly that period in time has been an inflection point and price action in growth stocks has been much more hit and miss since then as field position has not been great after these monster moves.

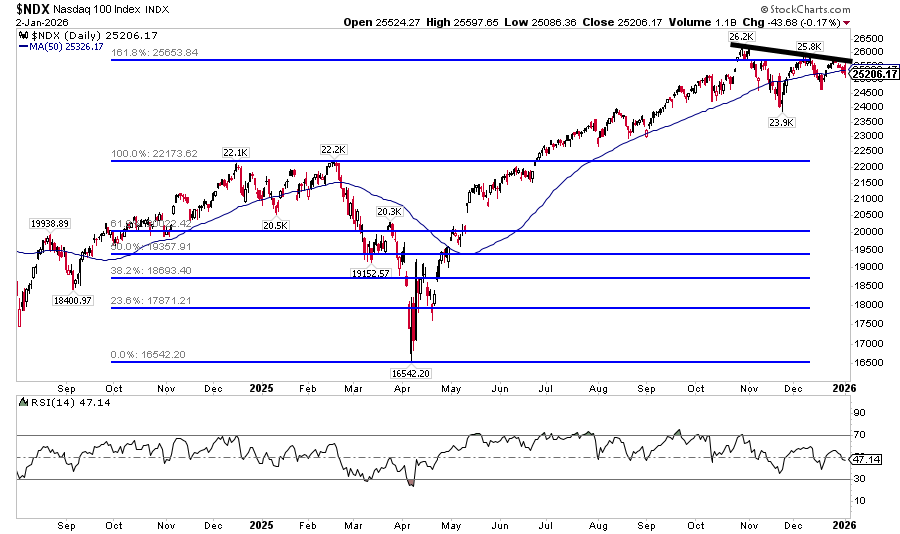

The Nasdaq 100 is going to be a great tell here. It kind of looks like a rollover setup, we’ll see how the January flows go.

Speaking of inflections - how about the two greatest investors of our time announcing their retirements in 2025?

Which if we really want to zoom out - they don’t ring a bell at the top, but even Hellen Keller can hear this one.

Of course i’m referring to Warren Buffett and Nancy Pelosi.

And as Warren Buffett calls it quits, his favorite indicator total market cap to GDP is at all time highs. The market *as a whole* is just very expensive.

Of course people will say valuations don’t matter. And that is exactly what they will say at the top. But much like the real world - total price levels are obscene.

Here is a snapshot of Palantir.

And with a valuation like this they better be teaming up with Israel and the US government to trap the entire western world in a digital prison.

And you never want to be like ‘that’s expensive, sell!’ But now, when the price action is pretty sloppy and could be a big top forming here - that stands out a lot more. This is certainly a name to keep an eye on in the coming weeks

One thing we may be seeing here is blindly passively investing in 2026 is a potential recipe for disaster.

Here’s big tech stocks (MAGS) relative to the S&P 500. Big tech stocks actually stopped outperforming a year ago. And now here we are with this thing trying to top out.

But having a little agency will go a long way

We can’t just blindly group AI together - since that recent inflection we have been getting rewarded for owning the stocks that benefit from very real, very drastic supply shortages in the semi and equipment spaces. Here’s a basket of names to illustrate the point

And it’s just obvious there are a ton of companies in great shape to make more money than anyone expects over the next few years. I recently added a page ‘Stud Stocks’ on the site to talk about many of them.

Of course the buy everything and hold bulls will tell you the central banks will just print. Yeah - the central banks can print all the money they want - but they cannot print trust, and trust is falling like it’s levered short silver.

And whether it’s trust in the system or trust that your fraud or scheme can continue - when you lack trust - you pull your money.

That seems a little problematic as estimates suggest 24 trillion dollars of government debt needs to be refinanced in 2026 with many interest rates across the globe loitering at generational highs.

So it’s pretty reasonable to expect periods where money is sucked out of the markets and illiquidity returns.

While there is that - what makes 2026 so interesting is it’s a peak year of state and corporate sponsored investment.

Of course as we enter this new year - people are pretty bearish the economy, pretty excited about debasement. But really this is the year set to benefit the most from Biden era infrastructure investment, defense spend etc. I think it’s just very hard for for the crowd in general to get a grasp for how slow these processes work - and that sets up opportunity for us - especially if there are broad market sell offs and/or events.

And while big tech may lag notably - their massive investments are really supporting numerous industries that had otherwise been left for dead. It’s really just a re-distribution of value if you think about it

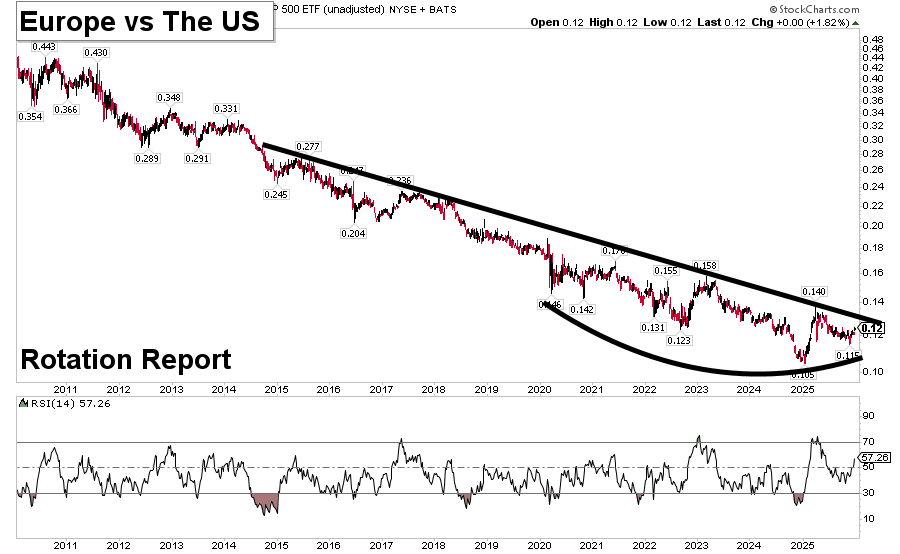

Speaking of - check out Europe vs the United States VGK/SPY trying to hammer out a higher low

Looking Ahead

And if we look ahead to this mid-term election year - lets start with what any AI will tell you:

The seasonal pattern suggests early year strength, met by weakness into say September/October which we want to buy.

And these mid-term election years can be dicey, tend to be one’s where

Incumbent parties do what they can to keep power. In this instance it requires a strong economy and getting the total price level down, ease housing constraints

Shit pops off geopolitically - which seems like a safe bet at this point

And this might not be popular, but it’s wise to do the mental exercise - hey what happens if China invades Taiwan and war pops off in the east?

The ramifications are huge.

And the base case for a first reaction might be something like ‘oh shit this is going to bring the global economy to a halt’ and then at some point that shifts to ‘oh shit entire supply chains need to be rebuilt elsewhere right now’

Which brings us to Miners vs Tech trying to complete a decade long bottom. This is as big a portfolio shift as we could imagine. Tech companies would have big problems while the metals are in shortage? Yeah that might do it.

And if you read the last free Rotation Report - it’s interesting, the charts suggest we want to prefer base metals over precious metals - we prefer energy over gold. We seem to prefer everything over gold at this point.

And one potential ramification of all these geopolitical happenings is a spike in bond volatility. You know Bessent is doing a great job keeping things calm, but there’s only so much he can control.

Just look at the 2 year US Treasury Yield

So to sum it up - this just sets up a year when it’s as important for our mindset to be in a good place and be prepared for some crazy shit.

On one hand, we’re going to want to be long assets that help you win the next war - and they might really bubble up, move aggressively.

But on the other hand it’s overwhelmingly likely pockets of illiquidity pop up and massive capital rotations continue.

There’s never been a better time for us to drastically outperform the indices. We just have to make it happen. And i’m confident we will