Peak Macro Tour

Hello Friends!

Thank god earnings season is here.

I mean, look at all these fucking white guys hammered drunk, living it up on the macro tour

They’re jumping from tariffs and global trade, to the basis trade, to realpolitik, to the end of ‘American exceptionalism’ and the US dollar, to reserve assets, to monetary policy, to Trump’s psychology etc.

It’s getting to be a bit much

And thank god Gold vs the S&P 500 has reached what has been a brick wall resistance area in the past. The February breakout was a huge risk off signal and maybe now the market can get a little relief, if only temporrary.

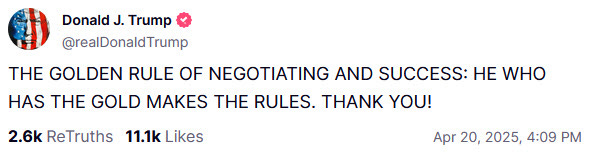

And of course Gold ripped 100 bucks on that Trump tweet. Sounds like a man with a full position, does it not?

Of course… he might just be talking about digital gold. Just look at that massive bull divergence in bitcoin vs gold as bitcoin starts to rip.

That’s right, give me that asset that doesn’t exist over bricks of gold. It’s much easier to transport, amirite?

We talked about these charts and more on last week’s stream if you missed it.

The big takeaway here is - the macro myopia is overdone.

Businesses are still in the business of doing business and earnings season is the time markets acknowledge that and price in how businesses are doing. In many cases, it’s better than feared.

Trade ‘em well