Happy Monday and yes another episode of The Stock Show is live on tape delay.

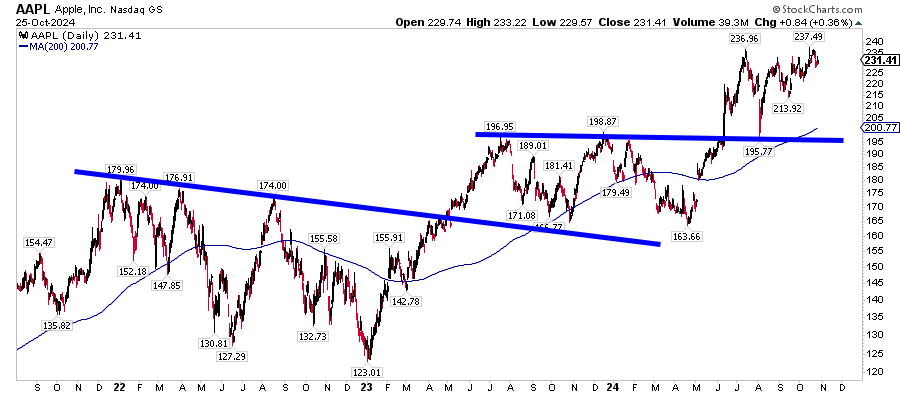

It’s 8 days until the election to end all elections! But before that we have a lot of mega cap tech earnings to talk about.

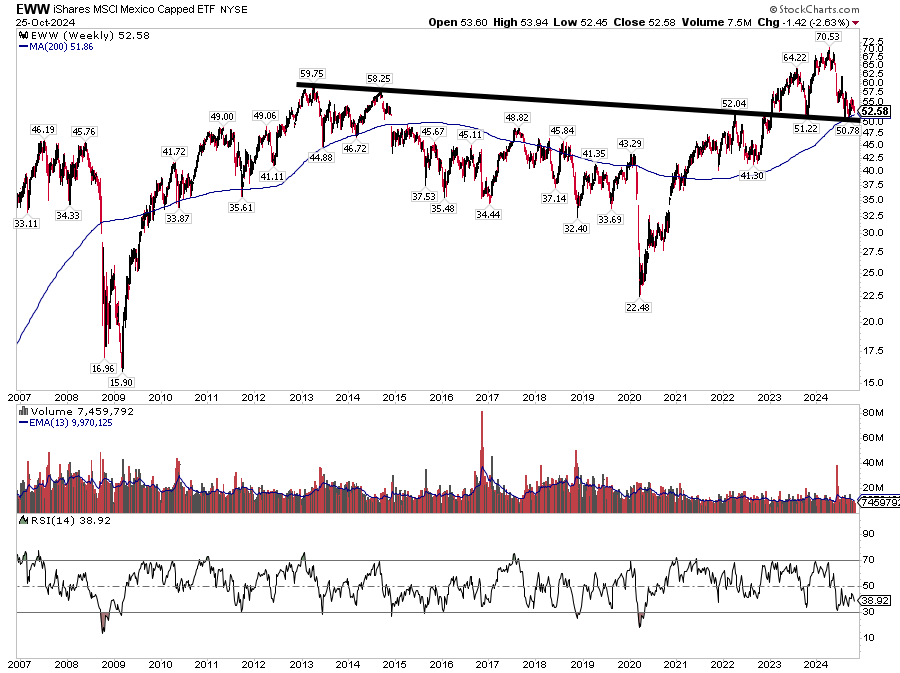

We've got a few Trump Trades covered and some trades shaping up around the election

We talk election strategy

Finally the deficit is exploding and market titans believe there is a huge disconnect in the bond market. What’s up with that?

Conspiracy notes

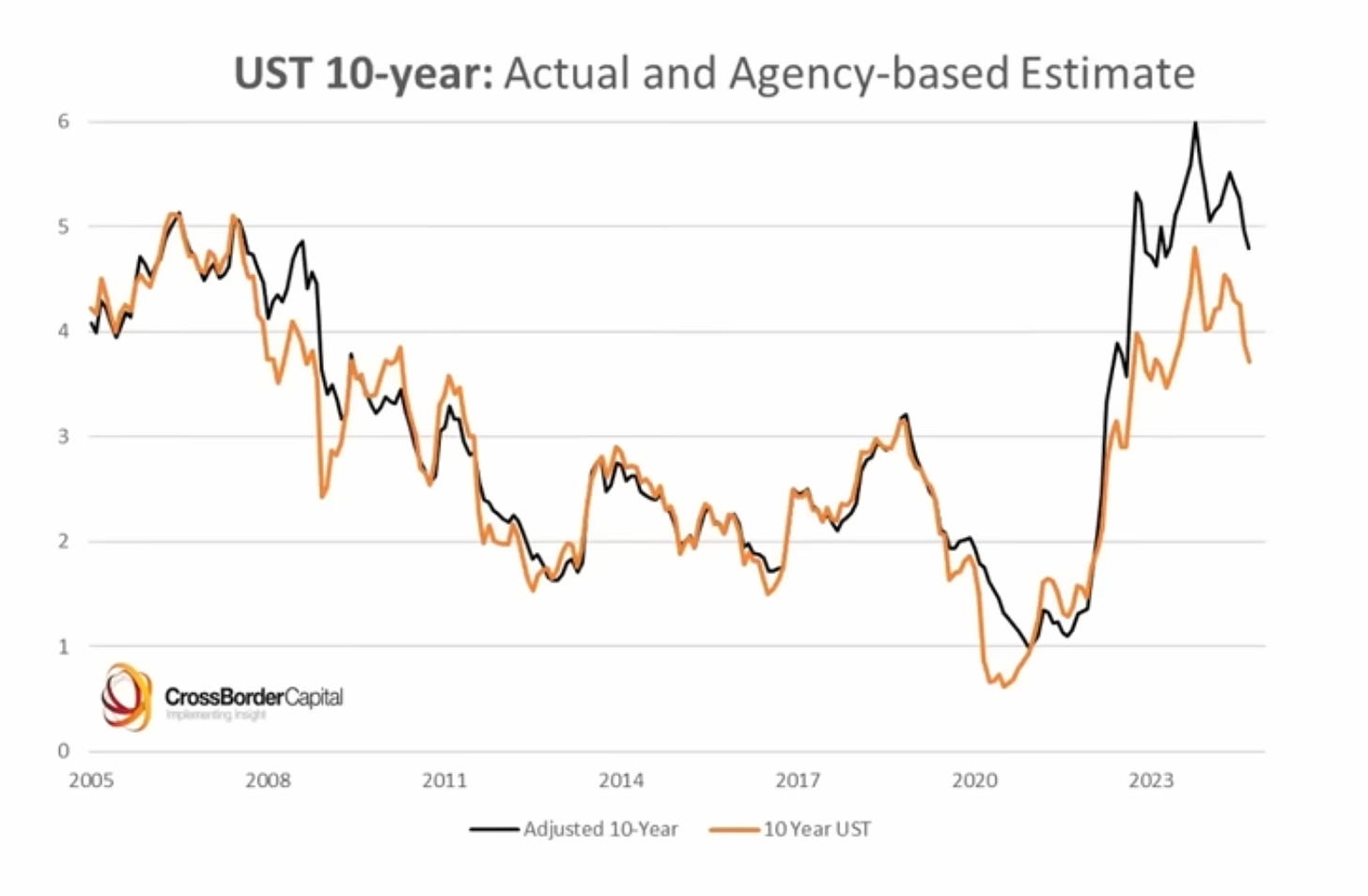

Stan Druckenmiller in a recent Bloomberg interview said he’s heavily short long term US treasuries. He noted the 10 year yield tends to track nominal GDP growth - which is 5.5%. Meanwhile it’s at 4.2%. today.

And just the other day Paul Tudor Jones 'i’m clearly not going to own any fixed income and i'm short the long end because it's just completely the wrong price’

So it’s the wrong price? What’s up with that? CrossBorder Capital is an awesome follow on twitter and the substack and has a great visual showing where a synthetic estimate of the 10 year yield is expected to be - basically 1% higher than it is. - 5%

How is this possible? The popular theory is the treasury has blasted the market with short term debt to keep the long end yields lower thus creating fake yield curve inversions, thus creating all those recession bears positioned that way. And - that tracks perfectly.

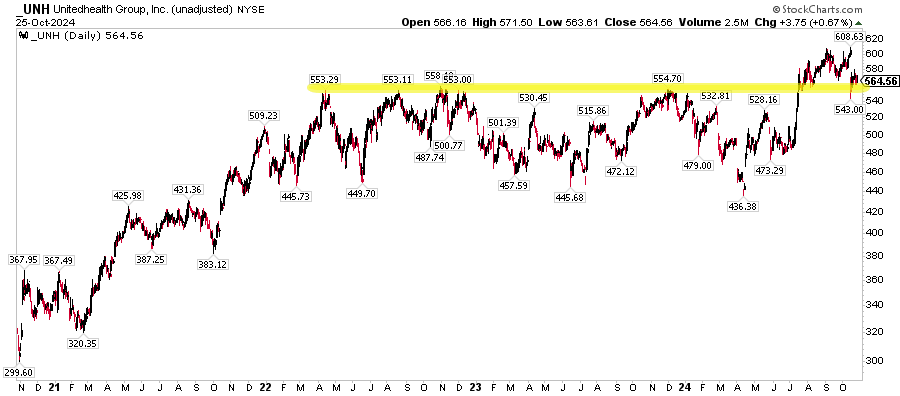

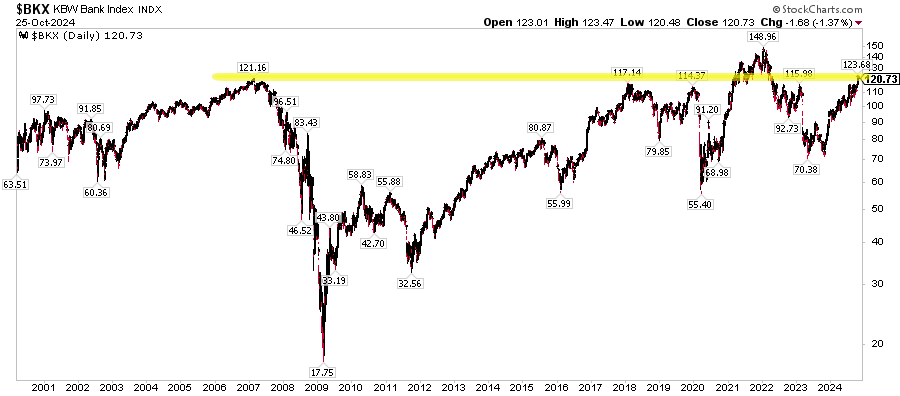

So yeah Banks are kind of interesting around this pre great financial crisis high area

Share this post