Breaking News: I’m looking to raise some money to buy some AI hardware and also search Northern Michigan for rare earth minerals. The bidding starts at a 2B valuation. Or - you know what - let’s just make it a cool 5. You can reach me at rotationresearch@gmail - TIA

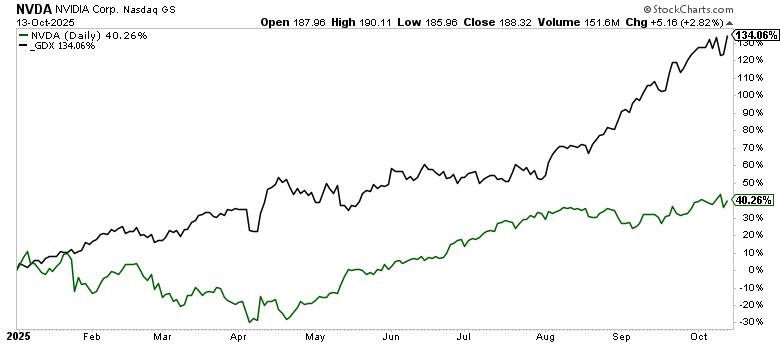

Yes the biggest trade of the year of course has been long all the metals.

That’s right - Jensen’s financing scheme is lagging gold miners by 100% this year. And we aren’t even going to get into the rare earths trade!

It feels like it’s so good that it can’t possibly continue - but what if this is just the beginning?

Do you know how much metal is needed to create the devices and infrastructure for people to complain about the rally all day?!

And if you pair long metals with short software - you have a ratio chart for the ages.

Metals are on the verge of outperforming software (and everything else) for - not weeks, not months, not years - but a generation.

That’s right, it’s time to get the National Guard out of the cities and send them to the antimony mines.

Our AI overlords need neodymium.

We’re just not just going to build out all these robots and energy without the rare earths right?

Bloom Energy needs scandium to reach 200 ok?!

And Yttrium brightens every room you are in and makes the screens of our digital prisons nice. Who doesn’t want a secure domestic supply of that?

Sure the mining is toxic - but what’s really toxic is not having control over every other nation on earth.

Don’t you agree?

Clearly China doesn’t - which is why they have stockpiled all the metals they can to back their currency - because nobody trusts them either.

So you see - all roads lead to metals.

Although who the hell is chasing gold into that next target zone 4200

But the big news of the day is JP Morgan making re-industrialization great again, adding a boost to - all the stocks that have been going up in a straight line for months

Surprisingly, we still have some ways to make money here