Chart Of The Day

Good Morning!

The tariff headlines are back. Those are always fun, but the crowd is conditioned to look past them at this point

But one thing we should not look past is Bond Yields

Just look at the global bond market - International Treasury ETF BWX. It’s at the top of a 2.5 year channel and just about reversing lower after trying to pop through.

You could say we’re at risk of a jump in global yields and maybe even the absolute bottom in yields for years to come.

Speaking of maybe a bottom in rates - how about the US 2 year Treasury Yield. There is a helluva floor here that has continually held around 3.5%

They say the rate cuts are coming and yields will drop. Well, we’ll see about that as this thing is coiled up and there is no doubt rate volatility is about to pick up in the coming months

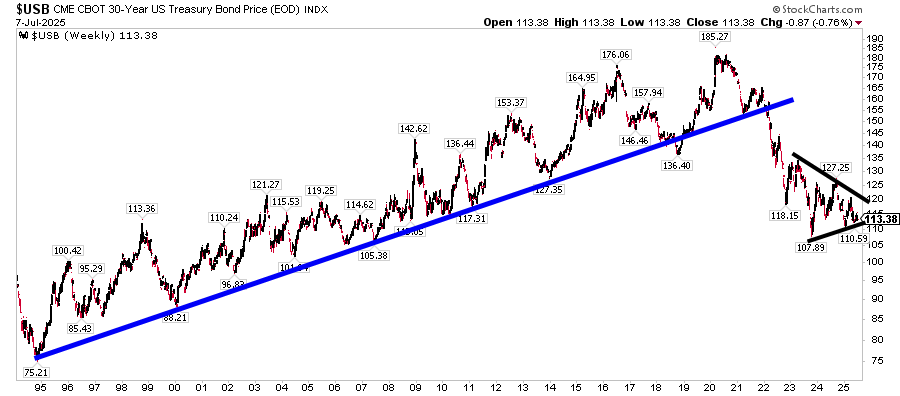

And while we’ve talked about 5% making a great reference point in the 30 year US Treasury Bonds, you can see this thing is coiled up and getting ready to move over the next few quarters as well.

A new leg in the global treasury bear market is the risk to keep an eye on in the coming months. No doubt it will be a huge headwind if it comes to that

Have a great day! - which, good luck with that if you’re pondering the implications of US Treasury yields hitting 7%